With the demand for low-carbon hydrogen set to rise, understanding the strengths and weaknesses of each electrolyzer strategy will hold the key to making smart investment decisions.

A trend paper in cooperation with consulting firm Apricum.

On the road to achieving the agreed climate goals, we predict that the global annual demand for low-carbon hydrogen will grow from less than 1 million metric tons in 2021 to 20 to 30 million metric tons by the end of the decade. Supplying green hydrogen will require 160 to 240 gigawatts (GW) of electrolysis capacity. This is a challenging target given that there are currently around 130 GW in the project pipeline and a total production output of 270 GW is estimated by 2030. To meet this target, all stakeholders will need to act quickly because, to date, a final investment decision has only been made for less than five percent of the projects announced.

Another key prerequisite to passing this milestone is the selection of the most suitable electrolyzer technology, which is a choice that is predominantly determined by the levelized cost of hydrogen. The technologies available all have different characteristics and their costs depend on the specific project parameters. This trend paper presents the differences between the four most advanced electrolyzer technologies – alkaline, proton exchange membrane (PEM), alkaline membrane and solid oxide technology.

The “work horse”: alkaline electrolyzers produce low-cost hydrogen when operated under a steady load

Alkaline electrolyzers generate hydrogen from a potassium hydroxide solution. This allows them to use a low-cost, porous membrane known as a diaphragm as well as catalyst materials (e.g. nickel) that are in abundant supply. However, this comes at the cost of limited operational flexibility. This is because the diaphragm is permeable to gases dissolved in the electrolyte, limiting the lower operational load to around 20 percent of the nominal load and requiring lengthy gas purging cycles during cold starts. This, in turn, leads to long start-up times. The separator’s high permeability also limits the electrolyzer’s hydrogen output pressure. Above all, alkaline electrolyzers are currently chosen for their record-low investment costs of 800 to 1,400 dollars per kilowatt for megawatt-scale systems.

The ideal project environment for alkaline electrolyzers are large-scale industrial installations requiring steady hydrogen production at low pressure levels. In this scenario, the electrolyzer is typically connected to the power grid and operated at a high rate of utilization. The levelized cost of hydrogen is largely dependent on the electricity costs, with hydrogen transportation and electrolyzer investment costs only making a minor contribution.

An example project is the 20 megawatts (MW) alkaline electrolyzer installed by Swedish steel manufacturer Ovako at its site in Hofors to replace the fossil propane gas used in its blast furnaces. The electrolyzer is connected to the local power grid, which enables stable operation, keeping the levelized cost of hydrogen low. Another example is the 5 MW alkaline electrolyzer used by UK-based gas distribution company SGN to replace the natural gas supplied to Scottish households with green hydrogen. The electrolyzer is largely powered by a local offshore wind turbine, but is also connected to the power grid to enable stable operation and steady hydrogen production.

The “race stallion”: proton exchange membranes (PEM) can respond flexibly to a fluctuating power supply

Unlike alkaline electrolyzers, electrolyzers with a proton exchange membrane (PEM) use a polymer electrolyte and produce hydrogen from pure water. The PEM’s acidic environment necessitates the use of costly materials such as platinum- and iridium-based catalysts, a perfluorinated ion exchange membrane and titanium-based electrodes, which drives the investment costs to 1,200 to 1,800 dollars per kilowatt.

The main benefits of PEM electrolyzers result from the membrane’s high gas barrier properties, which enable high output pressures, a rapid cold start and a broad operational load window. A further advantage of using pure water instead of an alkaline electrolyte is the reduced stress placed on the auxiliary equipment (e.g. pumps, valves and tubes), which results in longer maintenance intervals and lower operating costs.

PEM electrolyzers are ideal for off-grid installations powered by strongly fluctuating renewable sources of energy such as PV plants or wind turbines. The fast start-up and broad operational load window enable a higher rate of utilization than for alkaline systems. The location of PEM electrolyzers close to a renewable energy plant and the dynamic mode of operation often require the hydrogen to be compressed prior to being transported and stored. This way, the PEM’s ability to produce hydrogen at elevated pressures of up to 50 bar can be harnessed. In this scenario, the levelized cost of hydrogen is largely determined by the electrolyzer investment costs and hydrogen logistics, making the utilization rate and production pressure the key ways of saving costs.

PEM electrolyzers are therefore particularly well-suited to projects that are directly connected to PV installations generating a fluctuating amount of electricity. An example of this is the 20 MW PEM electrolyzer built by Spanish utility company Iberdrola, which is connected to a 100 MW PV plant in Puertollano and produces green fertilizers. Another preferred area of use for PEM electrolyzers are projects powered by fluctuating wind energy, especially where the electrolyzer is located offshore. The benefits of PEM electrolysis – namely high load variability, high output pressure and low space and maintenance requirements – come perfectly to the fore here. Examples include the 1 MW pilot project PosHYdon, which is located on a gas platform in the Dutch North Sea, and Siemens Gamesa’s SG 14-222 DD offshore wind turbine, which is equipped with an integrated PEM electrolyzer.

The “cross-country horse”: solid oxide electrolyzers

Solid oxide electrolyzers use high temperatures to increase system efficiency above 80 percent and to enable the use of abundantly available, low-cost catalyst materials. This requires a heat-resistant ceramic separator (solid oxide) to facilitate the transport of ions at temperatures of between 500 and 900 degrees Celsius. The high operating temperatures reduce the electrolyzer’s flexibility and put additional stress on all heat-exposed materials, limiting their service life. Solid oxide electrolyzers require low-cost heat to maximize their conversion efficiency and achieve a competitive advantage over PEM and alkaline electrolyzers. This limits their commercial potential. The world’s first megawatt-scale solid oxide system was installed by Sunfire at the Neste refinery in Rotterdam, with waste heat being used to pre-heat the steam entering the electrolyzer.

The “new colt”: alkaline membranes provide attractive benefits for niche applications

Alkaline exchange membrane electrolyzers combine an ion exchange membrane with an alkaline electrolyte. This means that they bring together the main benefits of alkaline and PEM electrolyzers, namely a low-cost catalyst material and the operational flexibility created by gas-tight polymer membranes. The commercialization and industrial use of alkaline exchange membrane electrolyzers are restricted mainly by their low stack lifetime, which can be attributed to the limited durability of ion exchange membranes in alkaline environments.

PEM and alkaline electrolyzers dominate the short-term project landscape

The type of electrolyzer to be used has already been set in stone for around ten percent of the approximately 130 GW of projects in the pipeline for 2030. According to this data, alkaline and PEM electrolyzers are anticipated to account for almost equal shares of the market, while solid oxide remains a niche technology.

Alkaline electrolyzers are expected to be deployed with an average project size of 120 MW, which is almost twice that of PEM electrolyzer projects, which are projected to be largely used in decentralized settings with an average project size of around 70 MW. Alkaline electrolyzers have been chosen for all projects that are connected to the power grid and can be supplied by it, at least for backup purposes. PEM technology, on the other hand, offers a potential cost benefit over alkaline electrolyzers when it is connected directly to decentralized, fluctuating renewable sources of energy. Around 60 percent of the projects announced with a direct connection to renewable sources of energy are set to use PEM electrolyzers, while roughly 40 percent are expected to use alkaline electrolyzers.

##IMAGECENTER|3

Favorable electricity costs and the EU’s strict definition of green hydrogen have driven the proportion of projects with a direct connection to renewable power plants to around 90 percent. This supports the growing need for flexible electrolyzers and emphasizes the competitiveness of PEM electrolysis despite its high investment costs. Whether using PEM electrolyzers as opposed to alkaline electrolysis results in a lower levelized cost of hydrogen depends on the size of the project and its utilization rate.

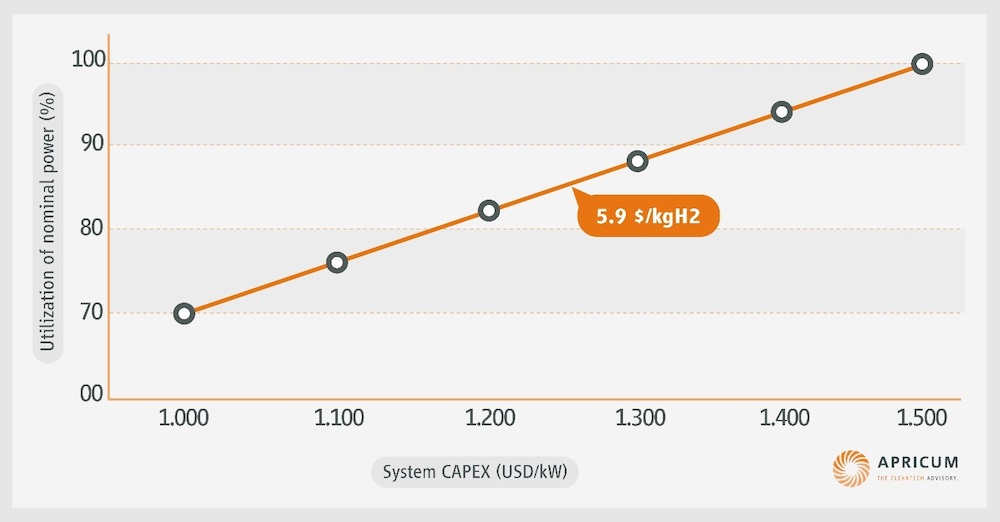

This can be illustrated by an iso-cost curve for different utilization rates and system CAPEX. An increase in the utilization rate of around 10 percentage points can justify higher investment costs of up to 15 to 20 percentage points for a 10 MW reference project with a baseline utilization rate of 70 percent and a system CAPEX of 1,000 dollars per kilowatt, while keeping the levelized cost of hydrogen at 5.9 dollars/kgH2. The maximum CAPEX difference that can be offset by utilization would be 50 percent for the same reference project.

The ideal electrolyzer combines the flexibility of PEM electrolysis with the cost of alkaline electrolysis. This is precisely what manufacturers are currently working on, with both technologies expected to be improved significantly in the future. Future alkaline electrolyzers will provide extended load ranges and shorter start-up times by incorporating next-generation separators with improved gas barriers and enhanced electrolyte circulation. At the same time, future PEM electrolyzers are likely to operate with lower quantities of platinum-group metals, which will reduce their investment costs.

Given their complementary advantages, both technologies are nevertheless predicted to coexist over the next decade. In the long term, hybrid systems are expected to be introduced that combine alkaline electrolysis stacks operated with a base load with additional PEM stacks to absorb temporary power peaks.

You can meet manufacturers and project partners at the Green Hydrogen Forum & Expo (hall B2, Messe München) at ees Europe from June 14 to 16, 2023. The Green Hydrogen Forum (booth B2.550) features a conference-quality presentation program on all three days of the exhibition and is open to all exhibition visitors.

Green Hydrogen Forum

The smarter E Podcast

Electrolyzer solutions for sustainable energy | Dr. Oldenburg, Apricum | The smarter E Podcast 118

For more information, please visit

www.ees-europe.com

www.TheSmarterE.de

Our trend papers provide you with background information and current developments in selected areas of the new energy world. Each trend paper is also available for download as a PDF version. The overview of all trend papers can be found on the website of The smarter E Europe.